iowa city homestead tax credit

July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. The tax year runs from July 1 to June 30 in Johnson County.

7 enter the tax levy for your tax district x004332624.

. Youll need to scroll down to find the link for the Homestead Tax Credit Application. If the property you were occupying as a homestead is sold or if you cease to use the property as a homestead you are required to report this to the Assessor in. If you do not receive acknowledgement please call our office at 712-328-5617.

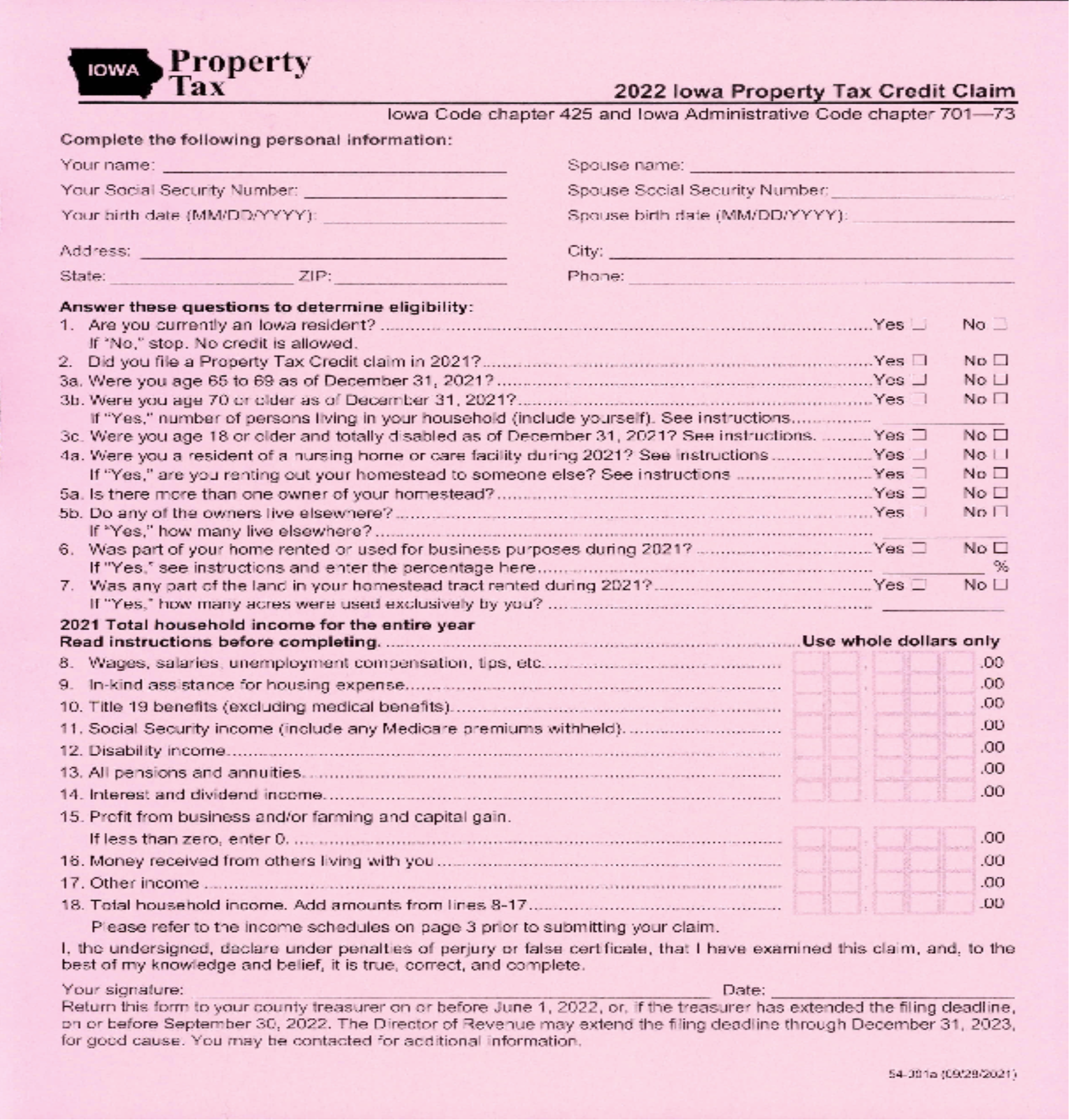

Application for Homestead Tax Credit. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. There is no warranty express or implied as to the reception.

Occupy the residence for at least six months of the year. Homestead Tax Credit Sign up deadline. 913 S Dubuque St.

Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. The Homestead Tax Credit is a small tax break for homeowners on their primary residence.

In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Sioux City IA 51101. Refer to Iowa Dept. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit.

Declare residency in Iowa. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. The amount of the credit is a maximum of the entire amount of tax payable on the homestead.

It must be postmarked by July 1. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. A homestead tax credit shall be allowed against the assessed value of the land on which a dwelling house did not exist as of January 1 of the year in which the credit is claimed provided a dwelling house is owned and occupied by the claimant on July 1 of that year.

Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. 54-028a 090721 IOWA. It must be postmarked by July 1.

Form must be provided as a pdf. It is a onetime only sign up and is valid for as long as you own and occupy the home. What is a Homestead Tax Credit.

52240 The Homestead Credit is available to all homeowners who own and occupy the. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone. This credit must be filed with the assessor by July 1 annually.

The credit will continue without further signing as long as it continues to qualify or until is is sold. It is the property owners responsibility to apply for these as provided by law. It must be postmarked by July 1.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. In the state of Iowa homestead credit is generally based on the first 4850 of the homes Net Taxable value and to qualify for the credit homeowners must. This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed.

Iowa City Assessor. Iowa Code Section 425. This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount.

To qualify for the credit the property owner must be a resident of Iowa pay Iowa income tax and occupy the property on July 1 and for at least six months of every year. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Of Veterans Affairs press release PDF Application Form.

Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. Homestead Property Tax Credit forms can be submitted by any of the below options.

Claim the property as their primary residence as opposed to a second home. 2015 HF 166 Veterans Credit modifying eligibility PDF Iowa Family Farm Land Credit. New applications for homestead tax credit may be filed in person with the Assessor or online at.

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. Upon filing and allowance of the claim the claim is allowed on that. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa.

Upon filing and allowance of the claim the claim is allowed on. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. Instructions for Homestead Application You must print sign and mail this application to.

To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1. The Assessorâs Office will acknowledge receipt of your email within 3 business days.

Property Taxes Marion County Iowa

Refundable Income Tax Credit For Property Taxes Paid To Schools Nebraska Farm Bureau

Everything You Need To Know About The Solar Tax Credit Palmetto

Available Tax Credits Deductions To Generate Cash Flow

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

How Taxes On Property Owned In Another State Work For 2022

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Moving Toward More Equitable State Tax Systems Itep

Property Tax Homestead Exemptions Itep

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

American Opportunity Tax Credit H R Block

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

What Is A Homestead Exemption And How Does It Work Lendingtree

Everything You Need To Know About The Solar Tax Credit Palmetto